net investment income tax 2021 proposal

Net investment income includes interest dividend annuity royalty and rental income unless those items were derived in the ordinary course of an active trade. Fortunately there are some steps you may be able to take to reduce its impact.

Billionaires Income Tax Proposal Seeks To Ensure That U S Ultra Wealthy Pay Their Fair Share In Taxes Equitable Growth

250000 for married taxpayers filing jointly and surviving spouses.

. The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year. This change would be effective as of September 13 2021 subject to binding written contract exclusion. Beginning in tax years after 2021 President Bidens Greenbook proposes to subject all trade or business income of individuals earning over US400000 to either self.

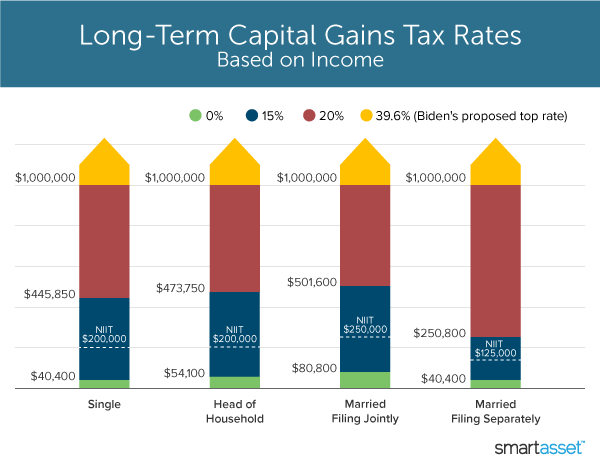

Expands the 38 net investment income tax for taxpayers earning over 500000 married filing jointly and 400000 single filers to include all pass-through income above and beyond investment income and wage income no change here. This increases the top capital gains tax rate to 25. Big Changes to Come.

38398 for Philadelphia residents. July 21 2021. The top federal rate on capital gains would be 434 percent under Bidens tax plan when including the net investment income tax.

The full credit can be claimed by married joint filers with modified adjusted gross income MAGI of up to 150000 single filers with MAGI of up to 75000 and heads of household with MAGI of up to 112500. Rates would be even higher in many US. Fortunately there are some steps you may be able to take to reduce its impact.

The NIIT applies to you only if modified adjusted gross income MAGI exceeds. Application of Net Investment Income Tax to Trade or Business Income of Certain High Income Individuals. For sake of simplicity we will refer to the Biden proposal as the New IRC Section 1061 Taxable Income limits.

High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax. Net Investment Income Tax NIIT on S Corp Profits If MAGI exceeds 500000 for a joint filer or 400000 for a single filer S Corporation profits will be subject to the 38 NIIT. B the excess if any of.

Ad Free 2021 Federal Tax Return. A the undistributed net investment income or. High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax.

Tracking the 2021 Biden Tax Plan and Federal Tax Proposals. The net investment income tax NIIT is a 38 tax on investment income such as capital gains dividends and rental property income. The proposal expands the scope of the NIIT to include all applicable income regardless of whether or not the taxpayer is a passive.

Fortunately there are some steps you may be able to take to reduce its impact. Net investment income includes interest dividend annuity royalty and rental income unless those items were derived in the ordinary course of an active trade. There is a phase-in range that creates some pretty interesting range calculation patterns.

The child tax credit for 2021 is 3600 for each child under age 6 and 3000 for each child ages 6 to 17. A special transition rule provides that the proposed maximum tax rate of 25 percent would only apply to qualified dividends and long-term capital gains realized after September 13 2021. 24 of 7099 all earnings between 2751 9850 170376.

Thai Income Tax Bands 2021. For estates and trusts the 2021 threshold is 13050. This proposal would be effective for tax years beginning after Dec.

High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax. These individuals are also exempt from the 38 Medicare or net investment income tax NIIT which currently applies only to certain passive income and gains. High-Income Surtaxes Taxpayers will be assessed a 5 surtax on.

Impose a minimum 15 corporate income tax on the book earnings of large corporations. States due to state and local capital gains taxes leading to a combined average rate of over 48 percent. The proposal would impose a 3 tax on a taxpayers modified adjusted gross income in excess of 5.

Keeps the qualified. E-File Directly to the IRS State. The increase in the base capital gains tax rate from 20 to 25 is proposed to be effective for most gains recognized after September 13 2021 while the 3 surtax and expansion of the 38 net investment income tax would be effective beginning in 2022.

PART II--Medicaid Provisions Sec. For 2021 the government will raise 275 billion in revenue generated from net investment income tax alone according an analysis by the Congressional Research Service. The NIIT applies to you only if modified adjusted gross income MAGI exceeds.

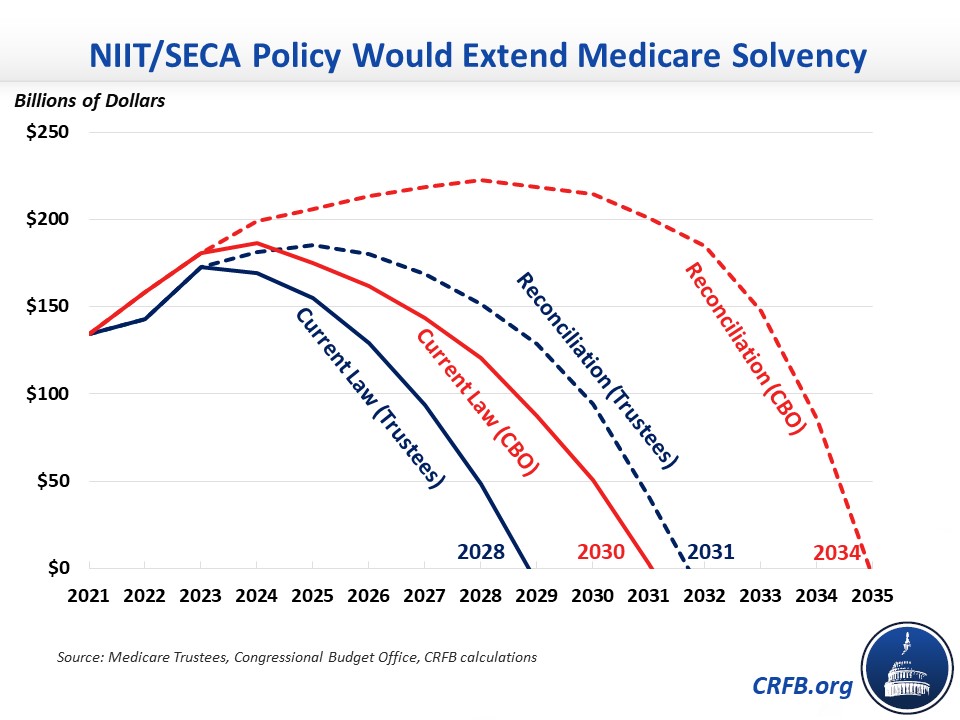

Net investment income tax. The income level that this capital gains rate bracket applies to would be aligned with the new 396 rate bracket. Ensure that all pass-through business income of high-income taxpayers is subject to either the net investment income tax NIIT or SECA tax.

At first blush the proposal appears to create two parallel systems. The NIIT applies to you only if modified adjusted gross income MAGI exceeds. By Richard Yam JD.

The proposal would increase the capital gains tax rate for individuals earning 400000 or more to 25 from 20. As Congress is now considering these tax law change proposals the following is a summary of some of the most important. November 3 2021.

This expands the net investment income tax to cover net investment income derived in the ordinary course of a trade or business for high-income taxpayers. House Ways And Means Committee Advances 2021 Tax Change Proposals Hcvt Holthouse Carlin Van Trigt Llp Income Tax Law Changes What Advisors Need To Know. The amount subject to the tax is the lesser of your net investment income or the amount by which your MAGI exceeds the threshold 250000 200000 or 125000 that applies to you.

In the case of an estate or trust the NIIT is 38 percent on the lesser of. The amount subject to the tax is the lesser of your net investment income or the amount by which your MAGI exceeds the threshold 250000 200000 or 125000 that applies to you. April 2021 Learn how and when to remove this template message On 2 May 2018 the European Commission presented its proposal for 2021-2027 multiannual financial framework A modern budget.

Eliminate incentives for fossil fuels and addincrease incentives for. New Income Tax Slabs Rates for FY 2021-22 AY 2022-23. 250000 for married taxpayers filing jointly and surviving spouses.

Increase the corporate income tax rate from 21 to 28. Increase in the maximum long-term capital gains rate The maximum capital gains rate would increase to 25 from the current rate of 20.

House Democrats Propose Hiking Capital Gains Tax To 28 8

What S In Biden S Capital Gains Tax Plan Smartasset

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Proposed Legislation Includes Tax Increases Focused On High Income Individuals And Corporations Koley Jessen

Reconciliation Could Improve Medicare Solvency Committee For A Responsible Federal Budget

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

How Will Capital Gains Tax Increases In 2022 Impact M A This Year Clearridge

What Is The The Net Investment Income Tax Niit Forbes Advisor

House Democrats Tax On Corporate Income Third Highest In Oecd

Like Kind Exchanges Of Real Property Journal Of Accountancy

House Democrats Propose Hiking Capital Gains Tax To 28 8

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

Seven Federal Tax Areas Businesses Should Be Focusing On During Year End Planning

Billionaires Income Tax Proposal Seeks To Ensure That U S Ultra Wealthy Pay Their Fair Share In Taxes Equitable Growth

Billionaires Tax On Capital Gains Invites Tax Collection Volatility